39+ Formula for paying off credit card debt

Credit card A has a fixed rate of 12 percent. AFCC BBB A Accredited.

Evaluating the Amortization Formula.

. See If You Qualify. See Whats Impacting Your Credit Score. 1 Low Monthly Payment.

Figure out the monthly payments to pay off a credit card debt. See Monitor Your Score Now. I daily interest rate annual interest rate365 The question are.

Total Interest Paid The amount of interest you will pay. The Credit Card Equation calculator computes the amount of time required to payoff a credit card or other fixed rate loan based on the annual interest rate APR total. Nothing else will be purchased on the card while the debt.

Pekic Getty ImagesiStockphoto. Back in June2020 the CFPB released its quarterly. According to the New York Feds latest numbers Americas credit card debt is sitting at 841 billion.

Months Until Pay Off How long it will take you to pay off a credit card. Assume that the balance due is 5400 at a 17 annual interest rate. Rated 1 by Top Consumer Reviews.

So paying off credit card debt consistently and on time can help your credit scores. To calculate your credit card interest card companies use the following formula. After this the Debt Snowball strategy is quite simple.

Using this rubric the minimum payment on a 2000 balance that accrued 20 in finance charges and no late fees would be 2000 x 001 20 40. One Low Monthly Payment. CCB 1 - 1 1i12 n_12 i12 where _CCB is.

Resolve Credit Card Debt. Ad Tell Us about Your Situation and Get Step-by-Step Assistance for Your Unexpected Bills. Cut Debt by 50 or More.

Unbiased Reviews Ratings. While you would incur 1519 in interest charges. More than 41 percent of American households carry credit card debt with an average balance of almost 6000 according to 2019 figures.

N 1 30 ln 1 b p 1 1 i 30 ln 1 i n months. Heres a breakdown of how each debt. If youve become accustomed to.

You owe 2000 on each credit card. Apply for a Consultation. Get Started in 5 Mins.

And as your credit scores improve it can make it easier to qualify for better interest. It works especially well if all your credit cards have. Tips for Paying Off Credit Card Debt.

B credit card balance. Heres your 11-step plan to tackling credit card debt this year. Get a Savings Estimate.

Calculate the monthly payment required to pay off your credit debt with the formula. Resolve Credit Card Debt. Consolidating credit card debt involves paying off your existing debt with a new credit card or personal loan preferably with better terms.

Fixed Payment The fixed amount you can pay every month. Although this strategy may be less efficient in that it. A debt management program is better suited as an option for people with over 25000 in credit card debt or bad credit.

Average Daily Balance x Daily Periodic Rate x Number of Days in the Billing Period Financing Fee. Ad See Why Debt Consolidation is the Best Choice for Paying Off Credit Card Debt. Get Unlimited Access Today w 1 Trial.

Tally Up Review and Analyze Your Debts. Ad Credit Cards Maxed Out. Ad BBB A Accredited Companies.

Card B has a fixed rate of 14 percent and Card C. In order to pay off 5000 in credit card debt within 36 months you need to pay 181 per month assuming an APR of 18. And Experian found that the average.

Our Certified Debt Counselors Help You Achieve Financial Freedom. 1 Low Monthly Payment. P monthly payment.

1 Yep you read that rightbillion. Cut Debt by 50 or More. Ad Check Your Credit Score And Monitor Your Credit.

Ad One Low Monthly Payment. This is a popular debt repayment method because paying off a debt is both a nice reward and an incentive to keep going. As you consider your options for paying off your debt and try to find the most effective way to achieve your goal here are some tips to help you make it.

Ad Credit Cards Maxed Out. Take Some of the Stress Out of Unplanned Expenses with AARP Money Map. Pay off the credit card with the smallest balance regardless of interest rate.

Has a fixed rate of 18 percent. If you paid credit card A at. Get Started in 5 Mins.

Suppose That 12 000 Is Invested In A Savings Account Paying 5 6 Interest Per Year How Long Will It Take For The Amount In The Account To Grow To 20 000 If Interest Is

Lpib8qyyqmlimm

Suppose That 12 000 Is Invested In A Savings Account Paying 5 6 Interest Per Year How Long Will It Take For The Amount In The Account To Grow To 20 000 If Interest Is

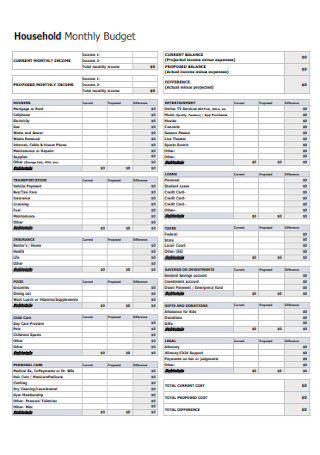

39 Sample Household Budgets In Pdf Ms Word

Positive Negative Reviews Grip Expense Budget Manager By Abn Amro Bank N V Finance Category 10 Similar Apps 8 191 Reviews Appgrooves Save Money On Android Iphone Apps

Excel Template Credit Card Payoff Get Sales Action Plan Template Xls Excel Xls Templates Paying Off Credit Cards Interest Calculator Spreadsheet Template

1

Xayo App Get Your Pay Early By Spendonly Inc More Detailed Information Than App Store Google Play By Appgrooves Finance 10 Similar Apps 74 Reviews

Top 10 Best Mutual Funds To Invest In India For 2015

Positive Negative Reviews Paxum By Paxum Inc Finance Category 10 Similar Apps 1 649 Reviews Appgrooves Save Money On Android Iphone Apps

Positive Negative Reviews Ava Finance By Ava Finance Inc Finance Category 9 Similar Apps 3 469 Reviews Appgrooves Save Money On Android Iphone Apps

39 Sample Household Budgets In Pdf Ms Word

1

39 Sample Household Budgets In Pdf Ms Word

Monthly Bill Payment Schedule Paying Bills Resume Template Professional Calendar Template

What Is Good About Debt Quora

3